Binance Pulse | BNB Price Trends

Binance Pulse | BNB Price Trends

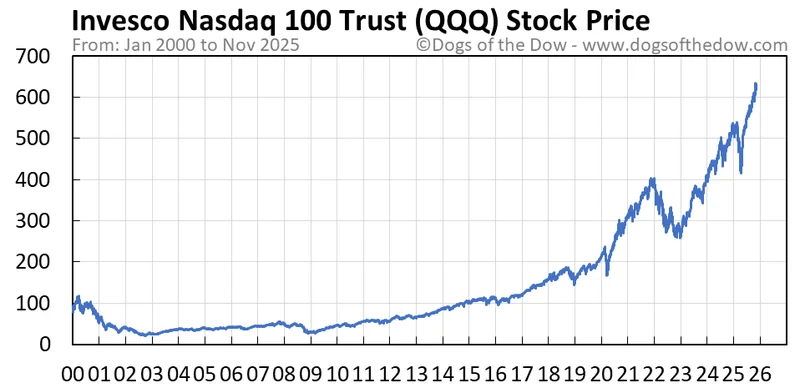

Okay, folks, let's talk about something that might sound scary at first: layoffs. The headlines are screaming about job cuts, especially in tech, and the Invesco QQQ ETF (QQQ), which tracks the Nasdaq 100, is feeling the heat. I saw one headline blaring about "Alarming Layoffs Data" hitting SPY and QQQ. But here's the thing: sometimes, what looks like a storm cloud is actually the harbinger of sunshine.

See, there's a narrative being built around these layoffs that I think is fundamentally flawed. We're hearing about companies like Amazon and Target trimming their workforces, and the immediate reaction is, "Oh no, the sky is falling!" But what if this is actually a sign of maturity? What if it's a necessary correction after the hiring frenzy of the pandemic, a strategic pivot toward a leaner, more efficient future?

One analyst pointed out that profit margins among the Nasdaq 100 have been quietly declining for a decade. Investors might not even realize it because reported earnings still look good, but that's largely because of how depreciation is accounted for. It's like painting over rust – it might look shiny for a while, but the underlying problem is still there.

But here’s where it gets interesting. Layoffs, while painful for those affected, can be a crucial part of a company's long-term health. Think of it like pruning a tree. You cut away the dead or unproductive branches to allow the remaining ones to flourish. These companies are streamlining operations, cutting costs, and, crucially, freeing up resources to invest in the next big thing. And what is that "next big thing"? Oh, you know, just world-altering stuff like AI and advanced automation!

One of the articles mentioned that companies are citing "AI adoption" as a reason for belt-tightening. Now, some might see that as a threat. I see it as an opportunity. It's a sign that companies are taking AI seriously, that they're not just throwing money at it but actually integrating it into their core strategies. This isn't just about replacing jobs; it's about reimagining work, creating new roles, and unlocking unprecedented levels of productivity.

And let's not forget about interest rates. Cleveland Fed President Beth Hammack is urging caution on rate cuts, wanting to keep inflation in check. Lower interest rates could boost the labor market, but they could also fuel inflation. What if the Fed’s careful balancing act ensures a soft landing, setting the stage for sustainable growth in the long run?

Look, I get it. Layoffs are never fun. People lose their jobs, families are affected, and it creates uncertainty. But as investors, we need to zoom out and see the bigger picture. We need to ask ourselves: what are these companies doing with the money they're saving? Are they simply hoarding it, or are they reinvesting it in the future?

I'm betting on the latter. I'm betting that these layoffs are a painful but necessary step toward a more innovative, more efficient, and ultimately more profitable future for the companies that make up the QQQ.

What does this mean for us? It means that now is the time to be smart, to be discerning, and to look beyond the headlines. It means doing your homework, understanding the underlying trends, and positioning yourself to benefit from the coming wave of innovation. And it's not just me who feels this way! Stock Market News Review: SPY, QQQ Blindsided by Alarming Layoffs Data as VIX Surges Peeking into the discussions, I found comments from individual investors buzzing with excitement about where the market is headed.

So, what’s the play here? Don’t panic. Don’t sell. Instead, see this as a chance to buy into the future at a slightly discounted price. See it as a chance to be part of something truly transformative. I first saw the potential of tech, I felt like a kid in a candy store – and this feels the same!